-

Find low rates in your state

Find low rates in your state -

Quotes form top companies within minutes

Quotes form top companies within minutes -

100% free, safe, and secure

100% free, safe, and secure

Senior life insurance plans can give you the comfort of knowing that you have helped to provide your family with financial assistance with your final expenses, paid debts, provided financial safety for a vulnerable family member or left a legacy Senior life insurance plans can be simple, often with no physical required, predetermined policy amounts for a given term or more complex whole life policies with more stringent requirements varying amounts payment plans and payouts.. Policies from a number of companies, life insurance for seniors and veterans group life insurance policies are available right here. Looking for burial insurance for seniors? Begin with a quote from AutoDriver.

Easier to obtain and less expensive than you may think! Life insurance for seniors helps with final expenses and obtainable for both men and women well past retirement age. If you are retiring and losing your company policy or just want to add a term life insurance policy for your senior years, AutoDriver is your source.

Get matched instantly with up to 20 insurers in your area. Shopping made easy.

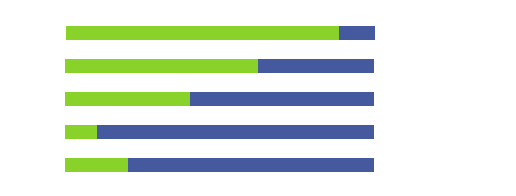

We suggest choosing at least 3 companies to find one that works best for you.

Comparison shopping can save you hundreds of dollars or more. Start saving today!

AutoDriver enables you to compare life insurance quotes through all in one streamlined platform, and save money on your life insurance plan. Instant life insurance savings are within reach with single premium whole life!

We’ve helped over 2 million people find life insurance in your area

Affordable coverage from $100,000 to $10,00,000

Get life insurance quotes from 15+ providers in just 2 minutes

No medical exam just health & other information

*This rates should not be considered to be, a recommendation of life insurance products of a particular insurer. Any rates listed above are for illustrative purposes only.

Senior life insurance is an important part of your retirement. Final expenses including medical bills continue to increase. Don’t leave your loved ones unprotected. At AutoDriver we have senior life insurance companies to provide you with competitive bids. For this important part of retirement make sure you choose a company that will be there when you aren’t. Find the one whose reputation, credit rating and service suit your senior life insurance needs.

The answer to that question is best decided by an assessment of your financial means and the needs both for yourself and other family members. That assessment should begin with a life insurance agent because insurance plans can be devised to suit your parameters and requirements. Discuss your ideas with an insurance agent you can contact right here and a plan and policy that will provide for you and your family’s desires can be written. Don’t leave your family unprotected when it is so easy to start the process right here at AutoDriver.

See the cheapest insurance rates available from top insurers

Our quoting service is 100% free, so comparing quotes won't cost you anything

No Agents, No Hassle. Save Up To 30%* on insurance

The quoting process uses the same standardized questions insurers use

We’ve already helped millions shop for life insurance

Shop directly with one of our partners.

Insurance policies can be custom fit to your needs and wishes. Amounts up to $500,000 are available in increments of $1,000 that can be used to settle final debts, provide for burial and other expenses or secure a spouse, disabled child or provide a legacy. A policy can also be used to provide income after retirement if you are still working. Other simpler plans with fixed amounts, no physicals and paid for an agreed upon term are also available, some even have cash value at the end of term. All of these plans can provide peace of mind to you and other family members. Contact an agent here and discuss the policy that is the best for you!

Yes, this topic, no matter how troubling it may be, is one that all of us must have with our family. If it is never discussed, a family can be left with not only the loss of the loved one but financial worries as well. The costs of interment or cremation are significant and increase every year. Don’t let that happen to your loved ones. Thinking about burial insurance for seniors should be a part of all financial and retirement plans. If you are a former military member consider life insurance for veterans as another option.

I had the option to choose what type of insurance based on my needs.

Eileen Hund

22 days ago

Eileen Hund

22 days ago

I was able to get an auto quote within 10 minutes. So quick!

Vannessa W.

13 days ago

Vannessa W.

13 days ago

My online experience for insurance plan to be efficient and very easy.

Alexandrea C.

10 days ago

Alexandrea C.

10 days ago

The ease of adjusting and comparing rates to see varied quotes.

Danee Wright

1 day ago

Danee Wright

1 day ago

Needed fast, affordable coverage, and I got it! Super easy!

Nozomi Kale

3 days ago

Nozomi Kale

3 days ago

Our comparison tool brings you 15+ personalized life insurance quotes from all the top insurers in your area.